Muchelemba Interviews Wantchekon

Reply

This is from a CGD paper by Scott Morris, Brad Parks, and Alysha Gardner:

The World Bank’s portfolio is more concessional than China’s portfolio in every region of the world, and sometimes dramatically so. The overall concessionality of China’s portfolio demonstrates less variation from region-to-region, hovering between 15%-22% in all regions except Europe and Latin America. By contrast, the overall concessionality of the World Bank’s portfolio varies widely — from a low of 15% in Latin America to a high of 60% in Sub-Saharan Africa (which is also the region where Chinese lending volumes are highest). The differences between China and the World Bank are most stark in Sub-Saharan Africa. Whereas the overall concessionality of the World Bank’s portfolio in Sub-Saharan Africa is nearly 60%, China’s portfolio concessionality in the same region is only 22.5% All three measures of lending terms contribute to these differences in portfolio concessionality rates: China consistently has higher interest rates, shorter maturity lengths, and shorter grace periods

Notice that China is neck and neck with the World Bank across Africa, unlike in other regions where Bank lending dominates. What proportion of Chinese lending in Africa are concessional loans?

Whereas the overall concessionality of the World Bank’s portfolio in Sub-Saharan Africa is nearly 60%, China’s portfolio concessionality in the same region is only 22.5% .

Recall that, overall, China is the single largest creditor to developing countries:

What we should make of African states’ indebtedness to China? A lot of people have opined that China is engaging in debt diplomacy — intentionally trapping African countries with high interest non-concessional loans, after which it will demand all manner of concessions from them (perhaps UN votes, or other forms of assistance in aid of Beijing’s geo-strategic objectives). I have two thoughts on this.

First, the Chinese debt bonanza seen on the Continent over the last two decades was driven, in part, by local demand for infrastructure and other visible and attributable forms of “development.” And yes, intra-elite distributive politics and over-pricing was also involved. And Chinese firms, which often competed against each other, played along, too — perhaps because of the reasons Yuen Yueng Ang describes in her latest book (highly recommended). With this in mind, it is not entirely true to claim that Beijing pushed loans on African states. While it is true that some of the projects were driven more by the quest for kickbacks than for economic reasons, the fact is that individual country dynamics drove the demand for loans and projects. Some of those fit into China’s global geopolitical ambitions (like the Belt and Road Initiative). Others did not.

Second, let’s think through the debt diplomacy game. Is the idea that China would ruin dozens of African states’ fiscal positions so much so that they would turn to Beijing for bailouts? How many Hambantota’s can China run across Africa? Does Beijing have the fiscal, military, or administrative capacity to do so?

The simple fact is that the use of gunboat diplomacy to settle sovereign debts is no longer kosher within the international system. My guess is that while Beijing certainly was out to buy influence with loans and other commercial relations, it also wanted to make money. Chinese officials were not running around peddling cheap concessional loans (see above). They were out looking for business for Chinese firms and banks. And so to the extent that African countries mismanaged their debt or invested in economically unviable infrastructure projects (even if in collusion with Chinese firms), that is on them.

Moving forward, it is clear that it will be in China’s best interest to make sure that its commercial relations in Africa do not stray too far from general economic viability. A strategic coddling of poor and weak allies will be very costly in the long run (see France in the Sahel). It will also likely turn African public opinion against China. For a long time, majorities of African publics have reported net favorable views of China. But this will most likely change if China morphs from a largely likable development partner building roads, power lines, and water works, to little more than a banker of tinpot tyrants in the business of building white elephants and saddling future generations with debt.

This is from a new paper by Alicia Barriga and Nathan Fiala in World Development:

Results from the tests showed very high levels of DNA similarity (above 98%) and good performance in general, but highly variable quality in terms of the ability of the seed to germinate under standard conditions. We do not see differences in average outcomes across the distribution levels, though variation in seed performance does increase further down the supply chain.

The results of the tests point to potentially important issues for the quality of seeds. The variation in germination suggests that buying a random bag of seeds in this particular distribution chain can matter a lot for farmer’s production. The high rate of seed similarity suggests that the main concern among policy makers and researchers, that sellers add inert or low-quality material to the seeds, is likely not the case, at least for the maize sector in the districts we study. However, given the remoteness of these districts and the lack of any oversight in these areas, we believe the results are likely a lower bound for the country as a whole.

The supply chain analysis suggests that the quality of seed does not deteriorate along the supply chain. The quality is the same, on average, across all types of suppliers after leaving the breeders. However, we observe high variation of seeds’ performance results on germination, moisture, and vigor, suggesting that results are more consistent with issues of mishandling and poor storage of seeds, possibly related to temperature or quality controls, rather than sellers purposefully adulterating seeds. Variation on these indicators is usually associated with mishandling during transportation and storage.

As the authors note in the paper, African governments and their external donors have put a lot of effort in “certification and labeling so as to reduce the possibility of adulteration by downstream sellers”. Obviously, e-labels and systems of verifying seed authenticity in the fight against adulteration are important. But equally important is an understanding of how the seed distribution system works. And that is one of the major contributions of this paper. Corruption is not always the problem.

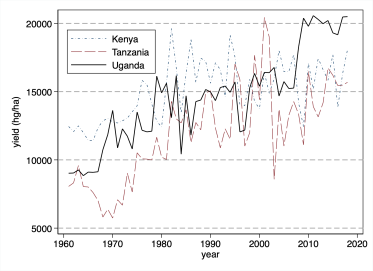

Interestingly, Uganda bests both Kenya and Tanzania on productivity in the cereal sector (I made the graph using FAO data). Despite starting off with relatively lower productivity and having gone through civil conflict beginning in the late 1970s, Uganda has since around 2007 clearly separated itself from both Kenya and Tanzania (and appears to have plateaued). Productivity in Kenya peaked in the early 1980s and has pretty much stagnated since. Tanzania’s figures appear to be trending upwards having collapsed in the early 2000s. There is likely an element of soil quality and general aridity involved in these trends. According to the FAO, Kenya and Tanzania use fertilizer at significantly higher rates than Uganda. For comparison, cereal yield in Vietnam is about 2.7 times higher than in Uganda.

It’s has been illuminating watching African governments respond to the COVID-19 pandemic. Here are some lessons I have gleaned from their responses. For those interested, the IMF has a neat summary of county-level policy responses.

[1] We need a lot more descriptive studies of African economies:

COVID-19 was slow to spread in African states (a reminder of the Continent’s isolating from global transportation networks. The first concentrated cases were in Egypt, largely among tourists on Nile cruises). But once cases started appearing across the Continent, governments rushed to implement policies that were eerily similar to those being implemented in wealthier economies. Complete lockdowns, tax breaks, business loans, and interest rate cuts were first to be announced. Cash transfers followed, but even then from the standard purely humanitarian perspective and not as part of a well-thought out, politically-grounded and sustainable policy response. Forget that African economies are (1) largely agrarian and rural; and (2) highly “informal” (i.e. under-served and under-regulated). How do you implement a lockdown when 80% of your labor force is dependent on daily earnings and cannot stock up on food for days? And how do you tell people “wash hands regularly” when the vast majority of your population lacks access to reliable running water? Do African states have the capacity to sustainably deliver cash transfers to needy households throughout this crisis?

In short, African states’ policy responses to the pandemic so far are an urgent reminder of the enormous gaps that exist between knowledge production, policymaking, and objective realities in the region. Now more than ever, there is a need for socially and politically relevant knowledge production. To bridge these gaps, African governments should invest in making their economies more legible. Such investments should target better data collection as well as the establishment of strong academic departments with expertise in political economy and economic history, in addition to other economics subfields. There is absolutely no way around this.

For instance, what do we know about recovery patterns after recessions in different African countries? How will the current shutdown impact rural livelihoods? African states cannot afford to continue making policy from positions of ignorance, or to outsource economic thinking and policymaking. Collect the data. Analyze the data. Have the results inform policy.

Such efforts will go a long way in helping craft domestic narratives and counter-narratives of socio-economic transformation, and hopefully entrench reality-based policymaking, in addition to putting an end to ahistorical and apolitical policymaking. Policymakers must understand that their economies are not simply Denmark waiting to happen.

[2] African governments should strengthen their policy transmission mechanisms:

One of biggest mistakes in the history of economic thought was the invention of the notion of “formal” and “informal” economic sectors. This arbitrary distinction continues to blind African policymakers, and limits their abilities to craft transformative policies. In most African countries, governments fixate on minuscule “formal” sectors, and spend billions of dollars attracting mythical foreign investors to create “formal” sector jobs (and in the process subsidize transfer pricing and the creation of very costly enclave economies). Meanwhile, the same governments ignore “informal” and agricultural sectors, despite the fact that in most countries they typically account for significant shares of output (see images) and upwards of 80% of the labor force.

The failure to adequately serve and regulate “informal” and agricultural sectors leaves African policymakers with a set of very blunt tools when it comes to these sectors. How will African governments ensure that SMEs are not completely wiped out by this crisis? How will farm-to-market systems weather the logistical problems caused by large-scale shutdowns? What will be the impact on food prices?

It makes little sense to lower SME taxes or incentivize bank lending to SMEs if the vast majority of SMEs neither pay taxes nor borrow from banks. “Informal” sector workers are typically also not plugged into any skeletal social safety nets that may exist, such as health insurance or pension schemes.

For example, “[i]n Senegal one 2016 government/Millennium Challenge Corporation study found [that] only 15 companies pay up to 75% of the state’s tax revenue.”

Moving forward, African countries need to jettison the “formal” vs “informal” sectors distinction. As the primary source of employment, the “informal” and agricultural sectors deserve a lot more public investments targeted at both broader market creation (domestic and international) and productivity increases. Such investments would give governments important policy levers during both good and bad times.

The fact of the matter is that agriculture and SMEs are the mainstays of African economies. It is about time that African states’ economic policies and budgeting reflected that reality. Failure to do so will continue to severely limit the efficacy of policy interventions, and leave governments wasting scarce resources attracting investments with very little multiplier effects in their economies.

[3] Elite complacency in Africa is about to get a lot more expensive:

One need not be wearing a tinfoil hat to see the many ways in which African leaders continue to act like colonial “Native Administrators”. Some do not even pretend to care about aspiring to govern well-ordered societies. For almost six decades the global state system has accommodated elite mediocrity in Africa. During this period, the collusion between African and non-African elites in the pilfering of the region’s resources was balanced with aid money and other forms of support.

That is changing. Western elites and publics have began to question the utility of foreign aid. Forgetting that the aid is what buys elite-level African alliances, they have come to expect loyalty from African states as a pre-ordained birthright. Many Western countries have also seen significant deterioration in the quality of their political leadership in the recent past, thereby exposing them to a range of domestic crises that will likely distract them into the medium term. China, the other major global player, is not ready to step into the void.

And so African elites will be forced to step up. What do you do when, after decades of presiding over abominable public health systems that are totally dependent on the generosity of foreigners, you cannot get on a plane to seek medical care abroad? And how do you deal with a pandemic that hits the entire globe at once?

It is no secret that the Global Public Health architecture was built to police and contain disease outbreaks in low-income countries. This has allowed African governments to routinely globalize their public health emergencies and therefore get away with poor governance and lack of dependable healthcare systems.

The combination of an inward orientation of the “international community” and likely recurrence of truly global pandemics will mean that African states will have to build robust and sustainable domestic healthcare systems. It will no longer be a given that the American CDC or the WHO will swoop in with solutions. Under these conditions, failure to plan will likely lead to mass deaths in African states.

[4] African progressivism needs a reset:

As Toby Green documents in A Fistful of Shells, modern African progressivism (defined as working towards broad-based transformative change) has a long history — going back to the 18th century. Men like Usman dan Fodio reacted to what they perceived to be elite complacency and moral depravity by organizing and seizing power. However, it is fair to say that the postcolonial variant of progressivism in the region has run out of steam. In nearly every country, it has become permanently oppositionist and anti-establishment. Life out of power has infused it with a streak of expressive performativity that is increasingly divorced from the political and economic realities in the region, and sorely lacking in intellectual rigor (there are exceptions, of course). Arguably, the Thomas Sankara administration (with warts and all) was the last truly progressive administration in the region.

It is about time that African progressivism focused not just on criticizing those in power, but also on developing viable political programs that can win power. This will require organization, political education and communication that resonates with mass publics, genuine openness to knowing “the realities on the ground”, and a dose of

principled ideological promiscuitypragmatism. The habit of waiting for perfectly enlightened voters and politicians under perfect institutional conditions effectively concedes the fight to the region’s shamelessly inept water-carriers.After 60 years in power, Africa’s ruling elites have become perhaps the most complacent lot in the world. Their destruction of higher education and the region’s intelligentsia in the 1970s allowed them to limit the role of ideas in politics and policymaking. It also helped that they found willing “apolitical” development partners in the “international community.” Even the most “progressive” among them care more about their countries’ rankings in the World Bank’s “Doing Business Index” than in the state of their “informal” and agricultural sectors.

It is time to infuse African leadership with new thinking and moral foundations of social contracts. Only then will the region’s states be in a position to build the necessary resilience to weather emergencies like COVID-19, and provide necessary conditions for Africans to thrive at home and abroad.

This is from the China-Africa Project:

In purely economic terms, China matters a LOT to Africa but Africa is effectively meaningless to China. Last year, China did more than $4.14 trillion in total global trade. So that means Africa represents just 4.8% of China’s global trade balance, effectively a rounding error for the world’s second-largest economy.

For some additional context, consider that China does more trade with just Germany ($225.7 billion) and about the same with Australia ($194.6 billion) than it does with all of Africa.

Alex Tabarrok over at MR has a fantastic summary of some of the works of this year’s three Nobel Prize winners in Economics. This paragraph on one of Michael Kremer’s papers stood out to me:

My second Kremer paper is Population Growth and Technological Change: One Million B.C. to 1990. An economist examining one million years of the economy! I like to say that there are two views of humanity, people are stomachs or people are brains. In the people are stomachs view, more people means more eaters, more takers, less for everyone else. In the people are brains view, more people means more brains, more ideas, more for everyone else. The people are brains view is my view and Paul Romer’s view (ideas are nonrivalrous). Kremer tests the two views. He shows that over the long run economic growth increased with population growth. People are brains.

Here is the abstract from Kremer’s QJE paper:

The nonrivalry of technology, as modeled in the endogenous growth literature, implies that high population spurs technological change. This paper constructs and empirically tests a model of long-run world population growth combining this implication with the Malthusian assumption that technology limits population. The model predicts that over most of history, the growth rate of population will be proportional to its level. Empirical tests support this prediction and show that historically, among societies with no possibility for technological contact, those with larger initial populations have had faster technological change and population growth.

Read Tabarrok’s entire post here. Highly recommended.

Since Sunday I’ve been asking around if the Prize got any mention on local radio in Busia, Kenya — the cradle of RCTs, if you will, and where Kremer conducted field experiments. No word yet. Will report if I hear anything.

This is from an excellent JDE paper by Humphreys, de la Sierra and der Windt:

We study a randomized Community Driven Reconstruction (CDR) intervention that provided two years ofexposure to democratic practices in 1250 villages in eastern Congo. To assess its impact, we examine behavior in a village-level unconditional cash transfer project that distributed $1000 to 457 treatment and control villages. The unconditonal cash transfer provides opportunities to assess whether public funds get captured, what governance practices are employed by villagers and village elites and whether prior exposure to the CDR intervention alters these behaviors. We find no evidence for such effects. The results cast doubt on current attempts to export democratic practices to local communities.

Here’s a description of the program:

Our study takes advantage of a large UK funded CDR program, called “Tuungane,” implemented by the International Rescue Committee andCARE International in 1250 villages throughout eastern Congo. The program had as a central goal to “improve the understanding and practice of democratic governance ….”

… Over a four year period, the program spent $46 million of development aid, reaching approximately 1250 villages and a beneficiary population of approximately 1,780,000 people. A large share of this funding was used for facilitation and indirect costs, with only $16m, 35% of the total program costs, going directly towards infrastructure. These shares reflect the fact that the main focus of the intervention was institutional change, not the use of existing institutions to deploy development funds.

This very cool paper raises important questions about the role of elites in African development (read it to get a better understanding of the futility of these kinds of “democracy promotion”, too).

It might seem logical to assume that short-circuiting elite power, whether at the local or national level, may lead to accelerated development. However, because a lot of “development” is often elite-driven, an explicit agenda of effective elite disempowerment might actually yield suboptimal outcomes. All else equal, elites are often better organized, better-placed to take risks (on account of having more economic slack), better able to protect their property rights, and routinely deploy the state to further advance their economic interests. $46m in the hands of a powerful and secure elite class might yield jobs in firms that provide economic stability for whole districts. It is also true that less powerful or stable elites are likely to squander it on consumption, quick profit schemes, or stash it abroad.

These observations are not unique to African states.

Overall, when I look at most African states, what I see are a lot of very weak elites lacking social power, constantly unable to bend their societies to their will, and resigned to low-equilibrium forms of political and economic organization (for example, by being mere middlemen in lucrative global commodity markets). In the case of the DRC, this is true whether one looks at Kabila/Tshisekedi or the leaders of armed groups in the east of the country. The same goes for so-called “traditional” leaders. Throughout the country and in the wider region, such elites lack infrastructural power in profound ways. Importantly for economic development, many often lack the ability to protect their own property rights. Our stylized idea of the nature of societal power relations on the Continent needs some updating. Consider this paragraph:

Eastern Congo is a well-suited environment to examine the adoption of democratic practice in local governance. The state has largely with-drawn from the rural areas of the east and enjoys low legitimacy. Local governance is often described as “captured” by traditional chiefs and vulnerable to corrupt practices by state officials. These features are not unique to the Congo. Multiple accounts suggest that in many Sub-Saharan states, colonial rule used pre-colonial institutions to create “decentralized despots” in ways that are detrimental to development.

Are local elites in the modal African country this powerful? Is this the sense one gets traveling in rural Ghana or Zambia? Do these (mostly) guys look like they are in charge? As the paragraph notes, “traditional leaders” often lack the means to coerce their constituents (the state is largely absent). Despite Mamdani’s persuasive (Rwanda) story, these are not powerful and unchecked “despots” in the standard sense.

Are local elites in the modal African country this powerful? Is this the sense one gets traveling in rural Ghana or Zambia? Do these (mostly) guys look like they are in charge? As the paragraph notes, “traditional leaders” often lack the means to coerce their constituents (the state is largely absent). Despite Mamdani’s persuasive (Rwanda) story, these are not powerful and unchecked “despots” in the standard sense.

At times Africanist scholarship on state/elite society relations can seem schizophrenic: Africa is the land of “imperial” big men elites who can scarcely project their power on account of state weakness (see here, here, and here). Since the early 1990s, a lot of effort has been put into taming the allegedly imperial political elites in the region. Missing in our analyses and in donor programs have been attempts to understand the structural weakness of these same elites and the attendant consequences. The presence of an erratic and parasitic elite class might be the proximate cause of underdevelopment in the region. However, I would argue that a deeper cause is persistent elite weakness in the region. Catherine Boone’s book (see image) is the best I’ve ever read on African elites’ strategies of power projection in a context of state weakness (Boone is easily the most underrated Comparativist of her generation).

The tenures of Africa’s Amins, Mobutus, and Bongos took the form they did in no small part because these were structurally weak leaders (long leadership tenure is not synonymous with state capacity). Throughout their times in office they did all they could to destroy any and all alternative centers of power (including institutions such as legislatures). Their failures reinforced their respective counties’ two publics problems whose legacy is chronic elite weakness that is obvious for all to see. To this day, very few African countries have stable economic elite classes with easily identifiable immovable assets in-country. Most operate like little more than Olsonian roving bandits.

I am yet to see a clear theory that links greater vertical accountability to state/elite capacity. The historical record suggests that democracy works best in contexts with pre-existing state/elite capacity. In my own work, I’ve shown how strong autocratic legislatures beget strong democratic legislatures.

This is not a defense of autocracy. It is a reminder that the processes of state and political development, while related, often run on separate tracks and should therefore be decoupled in programs such as the one above and in our studies.

This is from Marshall Burke and Apoorva Lal:

Using these data across all African countries, we calculate that 43% of the overall variation in asset wealth is within countries, and nearly a quarter is within states within countries. This number is even higher if we focus on just sub-Saharan Africa — 65%. Similar numbers have been found for other outcomes, including child health. These within-country differences are starkly apparent in the corresponding map, which shows how wealth estimates change when country-level averages are disaggregated down to the state and then district level.

This blogpost aims to explore the question of inflation in Rwanda, which has emerged as the last remaining issue required to resolve the disagreement about Rwanda’s poverty statistics. Using Consumer Price Index (CPI) price data, the National Institute of Statistics of Rwanda (NISR) (2016) and the World Bank (2018) claim that poverty decreased by 6 percentage points from 45% between 2010/11 and 2013/14, and then by a further 1 percentage point between 2013/14 and 2017/18 (NISR 2018).

Fig: extreme poverty rates accounting for inflation

However, blogs posted on roape.net (see the series, Poverty and Development in Rwanda on the website) have shown that the price data contained in the Integrated Household Living Conditions Survey or Enquête Intégrale sur les Conditions de Vie des ménages (EICV) survey itself, as well as in the separate ESOKO dataset, indicate a much higher inflation rate over this period, resulting in a sharp increase in poverty over the same period.

… This finding provides the first direct evidence of statistical manipulation as it means that NISR reported results that corresponded to a 4.2-4.7% inflation rate between 2011 and 2014, instead of the 13.8% inflation that it claims to have used.

You can read the whole post here.

The World Bank, which has repeatedly endorsed the figures coming out of Kigali, responded with this:

The key issue of Rwanda poverty measurement between 2010/11 and 2013/14 is that the consumer price index (CPI) and the NISR price index, called the Cost of Living Indicator (COLI), do not seem to be consistent. The national CPI shows that the inflation rate between 2010/11 and 2013/14 is 23%. NISR’s COLI uses the same CPI data, and the results show Kigali’s inflation rate is very similar to the national CPI trend, but other regions show very different trends. Further, the national average of COLIs show only around 5 percent for the same period, although there is no clear theory to guarantee that the national average of COLIs and the national CPI need to be consistent.

Is NISR’s approach flawed?

A working paper by Fatima and Yoshida (2018) found NISR’s 2016 approach – the latest official methodology – to be technically sound, but the inconsistency between CPI and COLI needs further research. The working paper, “Revisiting the Poverty Trend in Rwanda: 2010/11 to 2013/14,” is publicly available. NISR and World Bank teams are initiating a new joint research program, which will start in May 2019.

Is there any evidence that NISR manipulated poverty estimates?

No. NISR made all survey data and questionnaire as well as full documentation of their poverty measurement methodology freely available to anyone on their website. NISR has been fully open to any questions and requests from the World Bank team. Indeed, NISR welcomed technical views on their methodology and expressed strong interest in benefiting from global best practices. We have not found any clear sign of errors or manipulations.

The dispute appears to be over price indices. While I would not put it past an autocratic regime like Kagame’s to fake data, I also think that the Bank is taking on a lot of reputation risk for standing with NISR. I look forward to the outcome of the Bank’s joint research program with NISR.

A potential silver lining in all of this is that NISR will emerge as a more independent outfit (relative to politicians) that is guided by methodologically-sound approaches to making the country legible to its citizens and rulers.

First, a reminder that African governments are not uniformly bad at negotiating with China:

….when you look closely at what happens on the ground, some African countries are much better at negotiating with the Chinese than others. Railway projects in East Africa appear to be a good example. In Kenya, the Standard Gauge Railway is the largest infrastructure project since independence from Britain in 1963. China Eximbank provided most of the finance for the first phase – 472 kilometres of track between Nairobi and Mombasa – at a cost of US$3.2 billion.

In neighbouring Ethiopia, an electric train line from Addis Ababa to Djibouti, which is also Chinese-financed, opened two years ago. The cost for this more expensive type of railway was US$3.4 billion – for 756 kilometres. Kenya claims that its railway cost more for reasons like the terrain and the need to carry higher volumes of cargo. At the same time, however, many believe other issues to have been at play – including failures around the negotiation process.

Second, there are Soule’s suggested remedies:

Involve everyone: When all relevant government departments are involved in a negotiation, it does take longer. The process is more coherent, however, and the resulting project is less likely to breach national regulations.

Empower negotiators: The Chinese often adopt a take-it-or-leave-it approach. In many cases, Africans are not confrontational enough in return. They don’t appreciate that China has a surplus of domestically produced materials they are seeking to offload, for example. Wiser negotiators will play China off against other countries seeking to finance infrastructure projects on the continent, such as South Korea or the United Arab Emirates.

Keep the public onside: China tends to be popular in Africa – more so than the US in around 60% of countries on the continent. Yet the public also see negatives: many think Chinese products are poor quality, while there is a growing perception that dealing with China tends to favour Chinese labourers.

Increase knowledge: African governments are still relatively new to dealing with China; they should take every opportunity to share lessons with one another. There is a role for African universities here. They should set up more centres of Asian studies to close the gap in information and knowledge.

I fully agree.

While it is true that China has geopolitical ambitions in Africa, a lot of Chinese infrastructure plays in Africa are commercial in nature. It is in China’s interest that these projects succeed. That means that African governments could get better deals (in terms of value for money) by doing their homework (on Chinese politics and commercial and institutional architectures) before chasing the money. Similarly, public opinion presents a potential bargaining chip — (the threats of ) transparency and robust public participation should force Beijing’s hand in settling for better deals (from the perspective of African governments).

All this, of course, is predicated on the assumption that African elites get loans from China to finance infrastructure projects; as opposed to dreaming up projects in order to get loans that then find their way into private bank accounts.

This is from Yuen Yuen Ang’s excellent book on How China Escaped the Poverty Trap:

When foreign experts enter developing contexts and insist that there is one standard of good institutions — namely, that found in wealthy societies — this by itself imposes a lethal impediment against localized adaptation. Imagine “good governance” in medieval European communes being measured according to how closely they approximated institutions in the future. Then imagine foreign consultants dispensing praise and conditional aid to these European communes based on how well they score in good governance alongside contemporary countries; such an index would be titled “Worldwide and Timeless Governance Indicators” (WTGI). Further imagine medieval commune leaders and merchants being herded into classrooms to be taught about the technicalities of replicating institutions from the future in their current communities. Could this be an environment that empowers medieval actors to improvise fitting solutions for the needs of their time?

(Not that it used to work that well)

On Wednesday (Nov. 14) the Danish government said it would withhold 65 million crowns ($9.8 million) in aid citing allegations of human rights abuses. The minister of development cooperation Ulla Tornaes announced the decision on Twitter noting “negative developments” and “unacceptable homophobic statements.”

The day before, the World Bank suspended a $300 million educational loan following a government policy banning pregnant girls from going to school. That ban has been roundly criticized by the development community.

Tanzania most likely anticipated these specific reactions from the donor community.

And now news reports indicate the World Bank is walking back its suspension of the $300 concessional loan. According to the Tanzanian government, the Bank’s projects in Tanzania run to the tune of $5.2b. At some point the Bank’s board’s commitment to human rights and “good governance” runs against the cold calculus of having to signal effort by the amount of cash pushed out the door each year. Also, the net per capita overseas development assistance (ODA) to African states has been in decline over the last five years (see graph).*

And now news reports indicate the World Bank is walking back its suspension of the $300 concessional loan. According to the Tanzanian government, the Bank’s projects in Tanzania run to the tune of $5.2b. At some point the Bank’s board’s commitment to human rights and “good governance” runs against the cold calculus of having to signal effort by the amount of cash pushed out the door each year. Also, the net per capita overseas development assistance (ODA) to African states has been in decline over the last five years (see graph).*

For perspective, Tanzania’s budget for 2018/19 fiscal year is $14b. Which means that the total rescinded aid (if the donors keep their word) currently stands at 2.2% of government expenditure. If you factor in the “implementation surpluses” that typically arise due to suboptimal absorptive capacity, it is a wash. All to say that it’s not clear that these cuts (if the donors hold the line beyond the current news cycle) will inflict maximum pain.

How much aid goes into the government’s total budget?

Despite donors not meeting their commitments last financial year, the government expects to raise Tsh2,676.6 billion ($1.1 billion) from development partners which is equivalent to eight per cent of the proposed budget total funding.

In other words, the Tanzanian Treasury (and politicians) can absorb the hit on the country’s reputation emerging from policies and practices like this, this, and this without devolving into a fiscal meltdown.

*Population data from the World Bank. Aid data from Roodman.

Below is an amazing illustration of shifts in the sizes of leading global economies:

Wold GDP by Country pic.twitter.com/MqYJuyehAP

— Michael (@mnicoletos) November 1, 2018

For more on China see here, here, here, and here. This reminded me of this graphic from Carlos Lopes, former head of the UNECA:

All that happened in just 36 years. Time is on Africa’s side. If (and that’s a big IFF) African elites can get their act together. As shown in the graph below, the lost long decade (1980-1995) was particularly brutal for African economies — but it was a temporal dip and not a permanent feature of African economies.

It is also worth noting that in 1980 African states and China were not at the same level of institutional development. By that time China had already accumulated centuries of coherent stateness — which made it possible for elites to optimally allocate human and capital resources in ways that produced the growth miracle.

Here is a good nuanced take on trends in economic growth and development on the Continent.

This is a great piece on the subject in The Economist:

Something akin to Asia’s rural development may, at last, be happening in parts of Africa. Since 2002 the proportion of African workers employed in agriculture has fallen from 66% to 57%. Yet the real value of agricultural production has grown at an average pace of 4.6% a year, double the rate between 1970 and 2000. Even so, the region is lagging behind. Most of the increase comes from using more land, rather than improved productivity.

A good deal of the divergence in agricultural productivity after the 1970s is driven by African states failure to increase the use of fertilizers.

More broadly, smart policy to increase agricultural productivity must focus on market reforms (to ensure most of the surplus in the sector goes to farmers and to intensify financialization), rationalization of farm subsidy regimes, addressing the question of farm size (increasing urbanization may reduce the political cost of land consolidation in the region), and investing in logistics to reduce wastage between farms and markets (including transportation and storage).