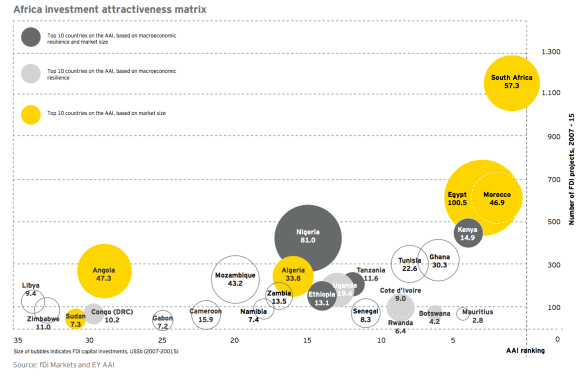

Africa continues to be a fertile ground for economic research. A significant number of economists in the development economics subfield have made careers explaining the “Africa” dummy variable in cross-national growth regressions — that is, explaining Africa’s “growth tragedy.”

In his latest book, Africa: Why Economists Get it Wrong, Morten Jerven argues that this is a misguided approach. Instead of explaining African exceptionalism (why is Africa poorer than the rest of the world?), Jerven argues that scholarly inquiry ought to focus on explaining fluctuations in African growth, and intra-Africa variation in general economic performance. Jerven persuasively argues that explaining African poverty and trying to find ways to fix it have distracted researchers and policymakers alike from the more useful endeavor of understanding how economic growth (and decline) happens in Africa. The former approach accepts as a stylized fact the lack of meaningful growth in Africa’s economic history; while the latter more realistic approach acknowledges that African economic history has been characterized by periods of both growth and decline.

Jerven is an economic historian, and it shows (see also here). He begins by reminding readers that African economic history did not begin in 1960, the time around which aggregate national economic data became available for a large number of African countries. Jerven then shows that economic growth in Africa has been cyclical, characterized by periods of both growth and decline. At the same time, periods of growth in Africa have not necessarily coincided with the implementation of “good” policies as the literature suggests. The “lost decades” of the late 70s and much of the 80s (due to oil and commodity shocks and associated debt problems) were a period of decline that also coincided with the “good” policies implemented under structural adjustment programs (SAPs). Without getting into the details of the specific policies in question, Jerven makes the point that African states’ experiences in the 70s and 80s are not representative of the full history of economic growth and development in the region.

Jerven is an economic historian, and it shows (see also here). He begins by reminding readers that African economic history did not begin in 1960, the time around which aggregate national economic data became available for a large number of African countries. Jerven then shows that economic growth in Africa has been cyclical, characterized by periods of both growth and decline. At the same time, periods of growth in Africa have not necessarily coincided with the implementation of “good” policies as the literature suggests. The “lost decades” of the late 70s and much of the 80s (due to oil and commodity shocks and associated debt problems) were a period of decline that also coincided with the “good” policies implemented under structural adjustment programs (SAPs). Without getting into the details of the specific policies in question, Jerven makes the point that African states’ experiences in the 70s and 80s are not representative of the full history of economic growth and development in the region.

Yet, according to Jerven, it is the growth record from these two decades that has become accepted as the “stylized fact” of Africa’s growth experience. The idea of an African growth tragedy has been so sticky that most economists (with a few exceptions) did not notice the uptick in growth in the region over the last decade and a half. A quick survey of syllabuses on African political economy will reveal this fact.

“Why is Africa poor?” is a question common on course descriptions in many American political science and economics departments, giving the impression that the region has always had a growth deficit to be explained.

Second, Jerven takes on the quality of data that have historically been used to study African economies (remember Poor Numbers?). In this part of the book he pokes holes through major papers in the economic growth literature. The data he looks at range from widely used stats on African economies from sources like the Bank, the IMF, country statistical departments, and other academic sources. He also questions the validity of outcome variables (such as institutional quality, property rights protection, et cetera) that are often found on the left hand side in cross-national growth regressions. Jerven does not seek to provide a review of the development economics literature. Instead, his focus is on the substantive implications of statistical models widely employed by economists to explain relative growth between different regions of the world. In doing so he challenges social scientists to think more careful about issues of measurement and the substantive meanings of regional dummies.

Jerven’s critique of what he calls the “Wikipedia With Regressions” style of academic research is welcome, and hopefully will inspire more students of economics and politics (not just in Africa) to invest in acquiring useful knowledge on the specific countries they study. The basic point here is that the cocksure certainty of findings in scholarly studies on the determinants of growth is unwarranted, given the shaky (data) foundations on which many of them stand. Jerven drives the point home by citing Durlauf, Johnson, and Temple who in their review of the growth literature found 145 different regressors that were found to be statistically significant determinants of economic growth.

Lastly, Jerven takes head on the claim that institutions and good governance cause economic growth. His core argument in this section is that “good” institutions are typically the result of, rather than the cause of economic growth. He gives examples of countries that have experienced sustained economic growth without having the typical bundle of institutions that scholars attribute to be the fundamental cause of long-run growth. I am partially persuaded by this argument, especially after having read Working With the Grain (see review here).

This latter section is the least strong part of the book, and may be the result of trying to do too much in one short text. As a student of institutions I am keenly aware of the importance of elite political stability and institutions that lock in intra-elite commitments for sustainable economic growth. It is not enough to claim that the view that institutions cause growth is misguided because some economies elsewhere have achieved growth without the hypothesized good institutions. I would argue, for instance, that a key difference between the “Asian Tigers” and their African counterparts (some of which we are often reminded were relatively richer in 1960) was the level of stateness (i.e. institutionalization of centralized rule) on account of a much longer experience with statehood. Jerven would have helped his argument by providing alternative explanations for Africa’s economic collapse in the late 1970s and much of the 1980s.

What kinds of institutions matter in “late” economic development? Why did African states almost uniformly fail to contain the oil and commodity shocks and the resultant debt problems that visited them during this period? Has there been institutional variation within Africa over time, and can it explain intra-Africa variation in growth?

Overall, Africa: Why Economists Get it Wrong is a fantastic quick read for anyone (whether in the academy or not) interested in understanding economic growth in Africa. Besides being a brilliant economic historian, Jerven is also an engaging writer with an ability to make even the most technical arguments accessible to the reader. I did not have the book on my original summer reading list but couldn’t stop once I started reading it.

In my view this book is the economics companion to Thandika Mkandawire’s excellent critique of scholarship on African politics. It also raises several very interesting questions that will inspire or reinforce a few dissertations in the field of development economics.