The Sentry, a project co-founded by George Clooney and John Prendergast, has a nice report that details corruption at the highest levels of the South Sudanese government.

How do President Kiir’s children afford to live in such apparent luxury? Corporate records for Combined Holding Limited (CHL), a South Sudanese holding company incorporated in February 2016, provide one clue. These records reveal basic information about the company: the date of incorporation, names of shareholders, their contact information and a copy of their passport. One of CHL’s shareholders is a 12- year-old child with the surnames “Salva Kiir Mayardit” whose passport lists his occupation as “Son of President.” But, this hardly makes this child unique among members of President Kiir’s immediate family.

In total, The Sentry found that at least seven of President Kiir’s children have held stakes in a wide range of business ventures, especially in the extractive and financial sectors. Corporate filings obtained by The Sentry show that South Sudan’s first family appears to be active in the country’s oil and mining industries. Another document obtained by The Sentry, dated June 26, 2015, indicates that Thiik Kiir—the president’s 28-year-old son—owned 35 percent of Nile Link Petroleum. Adocument filed in 2014 lists Mayar Kiir—Thiik’s 29-year-old brother whose passport also confirms he is the president’s son—as owner of half of Oil Line & Hydrocarbons Limited, with the remaining shares held by three Kenyan businessmen.

A document dated May 25, 2015, lists Mayar Kiir as a 50 percent shareholder in Specialist Services Co. Ltd., a company that describes itself as being involved in “oilfield services and petroleum supply.” Another document indicates that Adut Salva Mayar, the president’s daughter, has owned shares of Rocky Mining Industries Limited. Yet another document reports that Anok Kiir, President Kiir’s 29- year-old daughter, has held a 45 percent stake in CPA Petroleum. And, according to another corporate record, Winnie Salva Kiir, the president’s 20-year-old daughter, held an 11 percent stake in Fortune Minerals & Construction. The same document indicates that, as of March 2016, the three largest shareholders of Fortune Minerals are Chinese investors.

You should read the whole thing here.

You’d be interested to know that Salva Kiir and Riek Machar live  only a short drive from each other in Nairobi, Kenya.

only a short drive from each other in Nairobi, Kenya.

The idea that the leaders of South Sudan are stealing state resources left, right, and centre is totally abhorrent. Tens of thousands have died since the resumption of civil conflict. Millions are in dire need of humanitarian aid.

The international community has its work cut out for it. South Sudan lacks a functional state apparatus. It is yet to get to the point of stationary banditry.

Which is why I think that it would be misguided to presume that the key problems with South Sudan are endemic corruption or the lack of “good governance.”

Should we really expect the president of a (struggling) oil producing 5-year old state to make $60,000 a year and not dip into state coffers once in a while? After all, Kiir’s *perceived* peers are likely not some low-level bureaucrats here in DC but other leaders of the world and the Davos crowd. This is not to say that if Kiir were paid more he would necessarily be less corrupt. The point is that I am not particularly shocked that Kiir and his collaborators in the pillaging of South Sudan want and have acquired the same material comforts that most leaders in the world have.

The historically inclined might even argue that this is South Sudan’s enclosure movement.

Should one take that view, then the solution to the current problem would not be the *relative* impoverishment of the South Sudanese putative “upper class,” but investments in the expansion of this social category so that there is sufficient intra-elite accountability across the different socio-cultural groups in the country. The strategy of integrating rebel leaders into the SPLA could have served this purpose, but the downside is that it incentivized the proliferation of warlordism in the hope of being bought off by Juba.

Perhaps one of the most important questions to ask about South Sudan is how the international community can help Kiir and his henchmen invest their (ill-gotten) wealth in Juba instead of Nairobi or Kampala.

If left alone, South Sudan will likely remain to be a runaway kleptocratic failed state instead of gradually moving towards a stable state with sufficient coercive powers.

The student of the political economy of institutions in me is somewhat convinced that horizontal intra-elite accountability is probably the best way out for South Sudan (if they can establish intra-elite political stability to begin with). The hope that vertical accountability through regular “free and fair” elections will help keep a globalized elite running a fractious post-conflict state honest and accountable is phantasmic. At the moment the domestic audience costs for engaging in corruption are very low for Kiir and other elites, and will likely stay that way for the foreseeable future.

And don’t even mention “political will.” There are no “good” leaders in the world. Just properly incentivized individuals.

Again, definitely read the report.

only a short drive from each other in Nairobi, Kenya.

only a short drive from each other in Nairobi, Kenya.

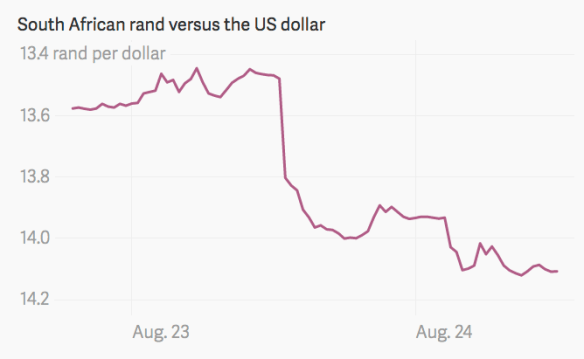

Analysts believe Gordhan is the target of president Jacob Zuma and his political allies. The two are reported to be at loggerheads over the management of South Africa’s state-owned enterprises, especially the national carrier South African Airways. Gordhan’s office has delayed bailing out the embattled carrier until

Analysts believe Gordhan is the target of president Jacob Zuma and his political allies. The two are reported to be at loggerheads over the management of South Africa’s state-owned enterprises, especially the national carrier South African Airways. Gordhan’s office has delayed bailing out the embattled carrier until